MI MC 48 2018-2025 free printable template

Show details

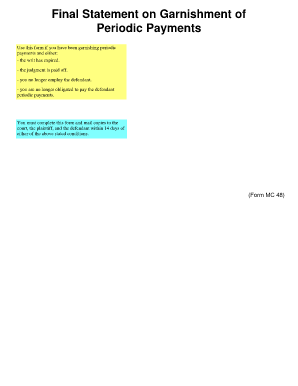

FINAL STATEMENT ON GARNISHMENT OF PERIODIC PAYMENTS Court address Court telephone no. Plaintiff s name and address judgment creditor Defendant s name and address judgment debtor v Plaintiff s attorney bar no. 101 B 1 or after the garnishee is no longer obligated to make periodic payments the garnishee shall file with the court and mail or deliver to the plaintiff and the defendant a final statement of the total amount paid on the writ. 1. The total amount withheld under this writ is Date of...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign form mc 48

Edit your garnishment periodic payments form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your final statement of garnishment michigan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mc 48 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit michigan form final. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MI MC 48 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out mc48 form

How to fill out MI MC 48

01

Gather necessary information: Ensure you have all relevant personal and financial details.

02

Obtain the MI MC 48 form: You can download the form from the official website or request a hard copy.

03

Complete the personal identification section: Fill in your name, address, and other identifying details accurately.

04

Provide necessary financial information: Input your income, assets, and any other required financial data.

05

Answer all questions: Ensure you respond to each question on the form to the best of your ability.

06

Review your entries: Double-check for any errors or missing information.

07

Sign the form: Provide your signature to verify that the information is correct.

08

Submit the form: Send the completed MI MC 48 to the appropriate agency or office as indicated in the instructions.

Who needs MI MC 48?

01

Individuals or families seeking assistance from Michigan's Medicaid program.

02

Eligible residents who require support for medical expenses.

03

Those looking to apply for healthcare coverage under the state's Medicaid guidelines.

Fill

mi mc 48 is a to income and business activities

: Try Risk Free

People Also Ask about garnishment release michigan

What is the maximum garnishment allowed in Ohio?

The total amount garnished cannot be more than 25% of the employee's monthly disposable earnings. Exemptions from garnishment, including, but not limited to, worker's compensation, unemployment compensation, disability payments, OWF payments, or child support or spousal support, and most pensions.

How do I dissolve a writ of garnishment in Florida?

(1) The defendant, by motion, may obtain the dissolution of a writ of garnishment, unless the petitioner proves the grounds upon which the writ was issued and unless, in the case of a prejudgment writ, there is a reasonable probability that the final judgment in the underlying action will be rendered in his or her

How do I stop someone from garnishing my wages?

5 Ways to Stop a Garnishment Pay Off the Debt. If your financial situation is dire, paying off the debt may not be an option. Work With Your Creditor. Challenge the Garnishment. File a Claim of Exemption. File for Bankruptcy.

How do I stop a wage garnishment in Ohio?

Request a Court-Appointed Trustee Under Ohio law, you may be able to avoid wage garnishment if you enter into a trusteeship. Trusteeships can stop wage garnishment and prevent creditors from harassing you for payment. A trusteeship requires that you pay a percentage of your earnings to your court-appointed trustee.

How long does a garnishment last in Michigan?

It is valid for 91 days or until the judgment, interest and costs are paid off, whichever occurs first. As such, the garnishment will continue each pay period for the 91 days or until the debt is paid off.

What is the maximum garnishment allowed in Michigan?

There are limits on how much a creditor can take from your earnings. A creditor can garnish whichever is less: up to 25% of your disposable earnings or the amount of your disposable earnings that's more than 30 times the federal minimum wage (currently $217.50).

How do I stop a garnishment in Michigan?

You file an objection by completing the form and filing it with the same court that signed the writ of garnishment. There is no cost for filing an objection except in probate court cases.

Can a garnishee order be stopped?

In simple terms, a “garnishee order” allows a creditor to force your employer to deduct money from your salary or wages to go toward repayment of an outstanding debt. Such orders can be cancelled, or rescinded by court application.

How long does a writ of garnishment last in Florida?

If a judgment creditor obtains a writ of garnishment against a bank all of a judgment debtor's accounts at the bank will be frozen until a court orders the money to be turned over to the creditor.

How long can your wages be garnished in Florida?

However, unpaid income taxes, court ordered child support, and student loans are the exception to this rule, they will not be required to obtain a judgment prior to seeking garnishment. Creditors will have up to 20 years to collect the funds owed under a judgment. See Florida Statute 55.081.

How long can a debt collector legally pursue old debt in Michigan?

The Fact About Michigan Debt Collection Laws and the Statute of Limitation. ing to Michigan law, your creditor has up to 6 years (from the date of your last payment) to collect on a debt, including obtaining a judgment on the debt.

How can I stop a wage garnishment immediately in Michigan?

You can use the Do-It-Yourself Objection to Garnishment tool if you have a reason to object to the garnishment. There is no cost to file an objection to a garnishment. You must file your objection with the court within 14 days of getting the notice of garnishment to stop the garnishment.

How do I stop a wage garnishment in Florida?

File an Exemption in Florida You must file a wage garnishment exemption form to request this relief. You can also try to use an example letter to stop wage garnishment if you have income that is protected from debt wage garnishments such as social security income.

How do I stop wage garnishments in Michigan?

Filing your ObjectionTop You can use the Do-It-Yourself Objection to Garnishment tool if you have a reason to object to the garnishment. There is no cost to file an objection to a garnishment. You must file your objection with the court within 14 days of getting the notice of garnishment to stop the garnishment.

Do garnishments expire in Michigan?

A writ of non-periodic garnishment is in effect for 182 days. This means the non-periodic garnishment expires on the 183rd day after the court issued it. After that you must request another writ of garnishment to keep collecting this way. It can only be used once; it expires when it is used.

How long can they garnish your wages in Michigan?

It is valid for 91 days or until the judgment, interest and costs are paid off, whichever occurs first. As such, the garnishment will continue each pay period for the 91 days or until the debt is paid off.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my MI MC 48 in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your MI MC 48 and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I fill out MI MC 48 on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your MI MC 48. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Can I edit MI MC 48 on an Android device?

You can edit, sign, and distribute MI MC 48 on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is MI MC 48?

MI MC 48 is a specific tax form used in Michigan for reporting certain information related to income and business activities.

Who is required to file MI MC 48?

Businesses and individuals who have certain tax liabilities in Michigan are required to file MI MC 48.

How to fill out MI MC 48?

MI MC 48 must be filled out by providing the required financial information and following the instructions available on the form.

What is the purpose of MI MC 48?

The purpose of MI MC 48 is to report income and ensure compliance with state tax regulations in Michigan.

What information must be reported on MI MC 48?

MI MC 48 requires reporting of income, expenses, deductions, and other relevant financial data as specified in the form instructions.

Fill out your MI MC 48 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MI MC 48 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.